What's Really Driving Up Auto Insurance Costs in South Carolina?

Auto insurance is something every driver needs, but most people don’t fully understand how it works or why it costs so much. It’s supposed to protect you financially, but lately, it’s become a source of stress, confusion, and rising bills. And while drivers are feeling the pinch, the insurance companies are doing better than ever.

Let’s take a closer look at what’s happening in the auto insurance world and why stronger regulation is long overdue.

Massive Premium Hikes

In 2024, the cost of car insurance jumped 12.8%. That followed a 14.4% increase the year before. These price hikes are happening much faster than general inflation, which stayed around 3%. So, while your paycheck isn’t stretching as far, your insurance premium keeps climbing.

Underwriting Profits Without Restraint

What makes this worse is that insurers are raking in profits. In 2024, the auto insurance industry’s “combined ratio” dropped to 95.3%, meaning companies made money from underwriting policies. Anything under 100% means they’re collecting more in premiums than they’re paying out in claims. Back in 2022, that number was 112.2%, so the improvement is dramatic. Even more striking, the percentage of money paid out on claims dropped from about 86% in 2022 to just 64% by the end of 2024.

Profits Fueled by Rate Increases and Wall Street Gains

But these improvements weren’t because people were driving safer or filing fewer claims. They were mostly the result of companies raising rates. So while drivers paid more, the companies paid out less. That’s not a win for consumers.

It doesn’t stop there. Insurance companies also made enormous profits from investments—over $163 billion in 2024. And when you take out one company’s unusually high capital gains, the industry still made about $100 billion in operating profit. In other words, they’re not just making money from your premium—they’re growing richer from Wall Street too.

Volatility on the Horizon

Experts are warning that this streak of profitability may not last. Analysts expect the industry to be less profitable in 2025 and 2026, with costs going up again and underwriting losses returning. Proposed tariffs on vehicle parts could also increase claims costs by as much as $61 billion a year, which will likely cause premiums to rise even more.

| Issue | Auto Insurance Reality |

|---|---|

| Consumer Protection Risk | Double-digit premium hikes burden drivers—even as profits soar |

| Profit Misaligned with Risk | Combined ratios below 96% reflect rate hikes, not risk reduction |

| Market Power Concentration | A few major insurers dominate pricing in many states |

| Macroeconomic Vulnerability | Inflation, tariffs, and parts shortages could quickly reverse profitability |

South Carolina Context: Why Regulation Matters Locally

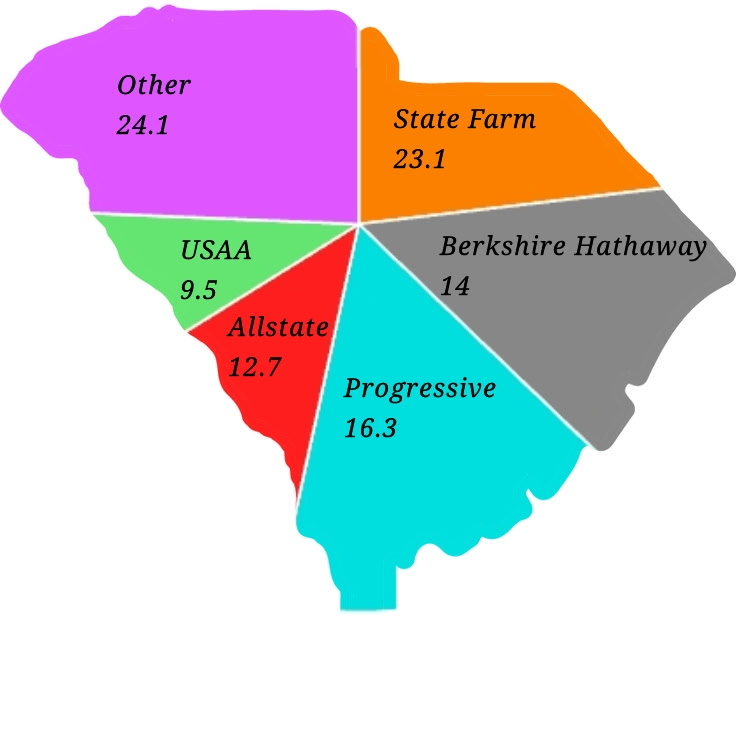

Here in South Carolina, the situation is especially tough. Our state consistently ranks among the most expensive for auto insurance. In 2025, full-coverage insurance averaged around $3,214 a year, or $268 per month. Why are we paying so much? One reason is that a few big companies dominate the market here. Just five insurers control nearly 75% of South Carolina’s auto insurance business.

With so little competition, they can raise rates without worrying about losing customers. And while our laws say insurance rates must be fair and based on actual costs, enforcement of those rules hasn’t kept up, especially as companies use more complex algorithms and AI to set prices. See, S.C. Code § §38-73-430(4); 38-75-970(A).

South Carolina’s Department of Insurance is responsible for reviewing rate changes and making sure filings are complete and justified. But as pricing becomes more sophisticated, our regulators need better tools and more authority to make sure insurers aren’t overcharging.

What Can Be Done?

First, insurers should be required to show that any rate hikes are based on real losses and claims—not just financial forecasts or investor expectations. Some states already have rules like this, and they help keep prices fair.

Second, companies should clearly separate the profits they make from underwriting (selling insurance) from what they earn through investments. That way, we can see whether rate increases are really necessary or just padding the bottom line.

Third, regulators in South Carolina need to closely examine filings, especially in a market this concentrated. More transparency, better enforcement, and a lower threshold for reviewing big rate changes would help protect consumers.

Finally, we need stronger national standards for how insurance companies set rates and explain them. The U.S. Treasury has even recommended this, urging consistent rules across states to make pricing fair and understandable.

The Bottom Line

Auto insurance has become a profit engine, driven by premium hikes and investment gains, not safety or claims efficiency. Consumers are paying more, often for less. Auto insurance is supposed to offer peace of mind. But right now, it’s becoming a burden for too many South Carolinians. Without stronger oversight, we risk a future where companies raise rates when it’s convenient, cut coverage when it suits them, and leave drivers unprotected when they need help most.

This isn’t just about math, it’s about fairness. Without stronger regulation, insurers can raise rates unchecked, exit markets, or underprice risk—leaving consumers vulnerable when they need help the most.

At Palmetto State Injury Lawyers, we’re here to help level the playing field. If you’ve been in a crash and the insurance company isn’t treating you fairly, call us. We fight to ensure you get what you’re owed.

Contact us today for a free consultation.

Categories

Bicycle Accidents Boating Accidents Bus Accidents Car Accidents Child Injuries Drunk Driving And Other Punitive Issues Food Poisoning Get To Know Us Head Injuries Insurance Motorcycle Accidents Pedestrian Accidents Personal Injury Premises Liability Prescription Drug Overdose Products Liability Property Damage Slip and Fall Accidents Traumatic Brain Injury Trucking Accidents Wrongful Death